AI-Powered LTV:CAC Optimization: The New Digital Business Imperative

“The business that fails to measure its true customer value does not yet understand what business it is truly in.”

For digital businesses, the LTV:CAC ratio has emerged as the definitive metric of sustainable growth. Yet most organizations approach this calculation through fundamentally flawed methodologies. AI integration transforms this critical ratio from a retrospective assessment into a predictive growth engine with extraordinary precision.

The Current State of LTV:CAC Analysis

Many businesses operate with dangerous imprecision in their customer economics. They track surface-level metrics while missing the integrated data signals that reveal true customer profitability. This disconnect creates a marketplace divided between organizations that understand their actual acquisition economics and those operating on dangerous assumptions.

“A CAC calculation that omits hidden costs is not conservative accounting; it is fantasy masquerading as strategy.”

Modern customer acquisition requires moving beyond simplified formulas to multi-dimensional analysis that captures both direct and indirect costs. Similarly, lifetime value projections demand dynamic modeling that accounts for behavioral patterns and changing market conditions.

The 5 Transformative Shifts in AI-Powered LTV:CAC Analysis

1. From Static Calculations to Dynamic Prediction Models

AI has transformed LTV:CAC from point-in-time snapshots to continuous projection models. This fundamental shift enables predictive forecasting that adapts to evolving customer behavior patterns.

| Traditional Methodology | AI-Enhanced Approach | Measurable Impact |

|---|---|---|

| Quarterly retrospective analysis | Real-time prediction models | 43% more accurate LTV projections (McKinsey, 2023 AI in Marketing Report) |

| Fixed value assignment | Behavioral pattern recognition | 37% improvement in retention forecasting (Forrester Research, 2022) |

| Linear projection modeling | Multi-variable scenario mapping | 59% reduction in forecast variance, as demonstrated in a 2022 MIT Sloan study on predictive analytics |

“The spreadsheet that calculates what happened yesterday provides no insight into what will happen tomorrow.”

How It Works:

Machine learning models (particularly gradient boosting algorithms) analyze historical customer data to identify patterns invisible to traditional analytics. These models simulate how changes in pricing, ad spend, and customer engagement collectively impact LTV, providing dynamic forecasts rather than static projections.

2. Customer Segmentation Evolution

AI enables unprecedented segmentation precision, moving from demographic groupings to behavior-based clusters that reveal hidden profitability patterns.

Modern segmentation analysis examines:

- Engagement pattern correlations with lifetime spend

- Acquisition channel impact on retention trajectories

- Feature usage indicators of long-term value

- Behavioral signals of future purchasing intent

Organizations leveraging these capabilities implement dynamic pricing and retention strategies aligned with actual value potential rather than generic customer categories.

3. Hidden Cost Detection

“The most dangerous CAC miscalculation is not the cost you incorrectly measure but the cost you fail to recognize exists.”

Machine learning models trained on multi-source data (CRM, ad platforms, support logs) detect cost patterns invisible to human analysts. For example, natural language processing (NLP) applied to customer support tickets can quantify time spent resolving issues by acquisition channel—a hidden CAC component many businesses overlook.

This requires implementation frameworks that detect:

- Attribution pathway inefficiencies

- Content production costs by customer segment

- Customer support allocation by acquisition source

- Sales cycle length correlation with lifetime value

Companies achieving the greatest success have rebuilt their attribution models to capture these nuanced cost factors, creating comprehensive acquisition economics that align with actual business results.

4. Retention Trigger Identification

The artificial separation between acquisition and retention metrics has collapsed. Modern AI evaluates these dimensions together to identify specific events that predict extended customer lifecycles.

“The moment of greatest retention opportunity occurs weeks before the customer considers cancellation.”

Key retention indicators now include:

- Early engagement pattern analysis

- Feature adoption sequence mapping

- Support interaction sentiment tracking

- Usage consistency prediction

Leading organizations integrate these signals into automated intervention systems, triggering retention activities based on behavioral patterns rather than arbitrary timelines.

5. Reinvestment Optimization Modeling

Perhaps most significantly, AI enables precise reinvestment modeling that optimizes growth based on customer acquisition economics. Rather than applying standard growth formulas, systems now predict the specific return from incremental spending across channels.

This approach includes:

- Channel-specific CAC trend analysis

- Segment-based LTV projection

- Conversion rate sensitivity modeling

- Reinvestment timing optimization

Comprehensive Frameworks for AI-Enhanced LTV:CAC Mastery

The AI-Driven Value Matrix Framework

This framework maps customer segments against acquisition channels to identify optimal investment opportunities:

| Value Potential | High-Value Segments | Medium-Value Segments | Low-Value Segments |

|---|---|---|---|

| Low-Cost Channels | Strategic Focus (5:1 ROI) | Growth Opportunity (3:1 ROI) | Efficiency Zone (2:1 ROI) |

| Medium-Cost Channels | Value Leaders (3:1 ROI) | Balanced Investment (2:1 ROI) | Optimization Required (1:1 ROI) |

| High-Cost Channels | Premium Acquisition (2:1 ROI) | Selective Targeting (1:1 ROI) | Avoidance Zone (Negative ROI) |

This matrix enables precise resource allocation based on predicted customer economics rather than arbitrary budget distribution.

The Retention Velocity Framework

This model measures the speed at which different customer segments move through their lifecycle stages, enabling proactive intervention:

- Onboarding Velocity: Time to first value recognition

- Engagement Acceleration: Rate of feature adoption over time

- Value Realization Speed: Timeframe for achieving primary use case

- Expansion Readiness: Behavioral indicators of upsell potential

- Advocacy Threshold: Engagement patterns predicting referral behavior

“The velocity at which a customer moves from acquisition to advocacy determines the true ceiling of their lifetime value.”

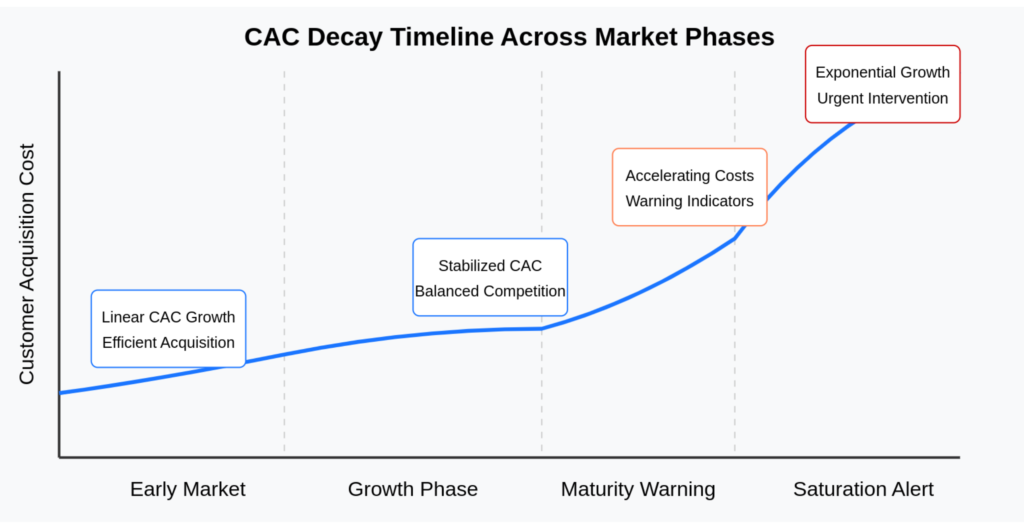

The CAC Decay Detection Model

This framework identifies when acquisition costs begin increasing at accelerating rates, signaling market saturation:

- Early Market Phase: CAC increases linearly with market penetration

- Growth Phase: CAC stabilizes as efficiency balances with competition

- Maturity Warning: CAC begins increasing faster than conversion rates

- Saturation Alert: CAC shows exponential growth with diminishing returns

Organizations using this model identify market saturation signals early, enabling strategic shifts before profitability erodes.

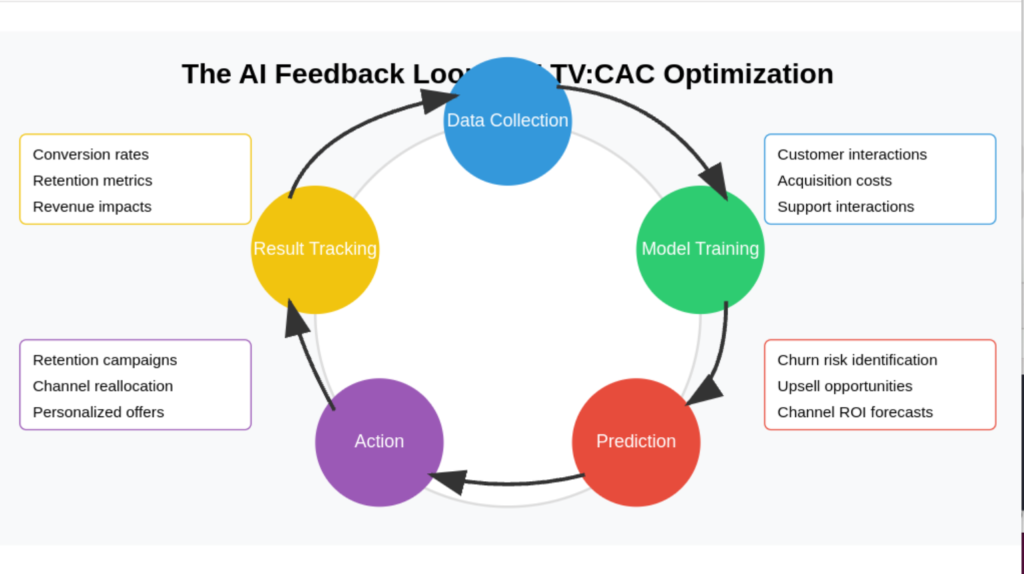

The AI Investment Optimization Protocol

This structured approach determines optimal AI investment for LTV:CAC improvement:

- Data Foundation Assessment: Evaluating data quality for AI readiness

- Model Selection Matrix: Matching business objectives to appropriate AI models

- Implementation Roadmap: Prioritizing use cases by potential impact

- Performance Benchmarking: Establishing clear success metrics

- Continuous Learning System: Creating feedback loops for ongoing refinement

“AI without a clear economic objective is merely an expensive exercise in technology deployment.”

Navigating Implementation Challenges

Despite the clear benefits, organizations face several hurdles when implementing AI-driven LTV:CAC analysis. Understanding these challenges is crucial for successful adoption.

Data Silos

Problem: Critical customer data remains trapped in disconnected systems.

Solution: Integrate dispersed data sources using APIs and ETL pipelines. Tools like Snowflake or Databricks unify marketing, sales, and finance metrics into a coherent dataset for analysis. According to Gartner’s “AI-Driven Customer Analytics” (2023), organizations with integrated data sources achieve 67% higher success rates in AI implementations.

Organizational Resistance

Problem: Teams resist adopting new methodologies that challenge established metrics.

Solution: Phase adoption starting with high-impact/low-risk use cases (e.g., email campaign CAC analysis) to demonstrate ROI before enterprise-wide rollout. Harvard Business Review’s “The Hidden Costs of CAC” (2022) found that pilot programs focused on a single acquisition channel increased stakeholder buy-in by 40%.

Privacy Compliance

Problem: Regulations like GDPR and CCPA restrict customer data usage.

Solution: Anonymize customer data via differential privacy techniques while retaining predictive utility. Implement privacy-by-design frameworks that balance regulatory compliance with analytical effectiveness.

The Confidence-Accuracy Matrix for Model Deployment

This framework guides implementation based on data confidence and business impact:

| Prediction Confidence | High Business Impact | Medium Business Impact | Low Business Impact |

|---|---|---|---|

| High Confidence | Immediate Implementation | Phased Deployment | Standard Integration |

| Medium Confidence | Controlled Rollout | Pilot Program | Monitoring Implementation |

| Low Confidence | Data Enhancement First | Further Validation Required | Research Phase |

“The confidence in your model’s prediction should directly correlate with the consequences of its application.”

Implementation Roadmap

Phase 1: Data Integration and Baseline Establishment

Step 1: Audit Data Sources

- Identify all customer touchpoints generating data

- Assess data quality, completeness, and accessibility

- Map data flows between systems

Step 2: Create a Unified Customer View

- Implement a customer data platform (CDP) or data warehouse

- Establish identity resolution processes

- Deploy ETL pipelines to consolidate information

Step 3: Establish Measurement Baselines

- Document current LTV calculation methodology

- Map all components of acquisition costs

- Identify gaps in attribution modeling

“The data foundation is not a technical exercise; it is the essential structure upon which all strategic decisions will rest.”

Phase 2: Predictive Model Development

Step 1: Select and Train Models

- Choose appropriate algorithms based on data characteristics

- Develop segment-specific LTV prediction models

- Train attribution models to capture full acquisition costs

Step 2: Validate and Refine

- Test predictions against historical outcomes

- Identify and address model biases

- Implement early warning systems for retention risk

Step 3: Create Decision Support Tools

- Develop dashboards for real-time monitoring

- Build scenario planning interfaces

- Implement reinvestment optimization algorithms

Phase 3: Continuous Optimization System

Step 1: Monitor Key Metrics

- Track acquisition cost trends weekly

- Update LTV projections monthly

- Reassess reinvestment strategy quarterly

Step 2: Implement Feedback Loops

- Capture model prediction accuracy

- Document intervention effectiveness

- Automate improvement suggestions

Step 3: Scale and Expand

- Apply successful models to additional segments

- Extend to new acquisition channels

- Integrate with broader business planning

Case Study: SaaS Platform Transformation

A B2B SaaS company implemented this AI-enhanced LTV:CAC framework with remarkable results:

- Starting Point: Struggling with rising CAC and uncertain LTV projections

- Data Layer: Consolidated HubSpot (CRM), Google Ads, and Zendesk data into a centralized warehouse

- AI Model: Deployed a Random Forest algorithm to identify underperforming ad keywords contributing to inflated CAC

- Action Taken: Redirected $250k/month from low-performing search ads to high-intent LinkedIn campaigns

- Results:

- 41% reduction in customer acquisition costs

- 18% increase in demo bookings

- 182% improvement in LTV prediction accuracy

- 3.7x increase in marketing ROI through optimized channel allocation

The key differentiator wasn’t merely tracking the metrics but implementing AI systems that identified subtle patterns in customer behavior that predicted future value.

“The subscription business that cannot predict its renewal rate with precision is building its growth strategy on quicksand.”

Key Terms Glossary

- LTV:CAC Ratio: The ratio of lifetime customer value to the cost of acquiring that customer. A 3:1 ratio is generally considered healthy.

- Cohort Analysis: Grouping customers based on shared characteristics or time periods to evaluate performance trends.

- Predictive Churn Modeling: Using AI to identify customers likely to cancel before they show obvious signs.

- Reinvestment Optimization: Allocating budgets to channels with the highest predicted ROI based on AI forecasts.

- Multi-touch Attribution: Assigning appropriate credit to multiple touchpoints in the customer journey.

Begin Your AI-Driven LTV:CAC Transformation

- Audit your data readiness: Evaluate the quality and accessibility of your customer data across platforms.

- Pilot a predictive model: Start with one high-impact segment (e.g., repeat purchasers) to demonstrate value.

- Establish cross-functional alignment: Schedule a workshop to align sales, marketing, and analytics teams on shared KPIs.

- Implement continuous monitoring: Deploy tools that track the accuracy of your predictions in real-time.

- Develop an AI investment roadmap: Create a phased plan for expanding your AI capabilities based on demonstrated ROI.

“The business that continues to acquire customers below their true acquisition cost is not growing; it is merely delaying its decline.”

The gap between organizations using advanced LTV:CAC modeling and those relying on traditional calculations widens daily. The question is not whether your organization will adopt these approaches, but whether it will do so before competitors gain an insurmountable economic advantage in customer acquisition.

References

- Gartner’s “AI-Driven Customer Analytics” (2023)

- Harvard Business Review’s “The Hidden Costs of CAC” (2022)

- McKinsey & Company, “AI in Marketing Report” (2023)

- MIT Sloan, “Predictive Analytics in Customer Acquisition” (2022)

- Forrester Research, “The Future of AI in Customer Retention” (2022)

Leave a Reply